Investment Strategies

Helping Investors & Companies In Transforming Their Investment Into Fortunes

The term investment strategy alludes to a bunch of standards specially designed by our investment market experts to assist you in accomplishing your monetary and investment objectives. This strategic approach is the very thing that guides an investor to make choices in the view of:

- Objectives

- Risk Resistance

- Future Requirements For Capital

- Monetary Growth

Every Decision Backed By Industry Experts

When it comes to investment strategies, a team of more than 20 expert research professionals supports the active management of productive investment strategies. Our distinctive, forward-looking approach to profitable research examines not only past performance of your investment but also the future outlook.

- Equity Research

- International Research

- Mutual Funds Research

- Asset Management Research

Set objectives on how much money is expected by you in the coming future. This will permit you to sort your brain out whether you want to put resources into long-term or momentary ventures and how much return can be actually expected.

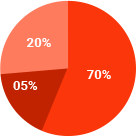

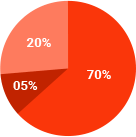

Select an ideal portfolio out of the spectrum of portfolios which instantly meets your aim. The portfolio which promises maximum return on the investment at the lowest possible risk is an ideal portfolio.

Know how much risk you can endure to get the ideal return. This additionally relies upon your present moment and long-term objectives. If you are searching for a better yield in a brief timeframe, the amount and level of risk would be higher and vice versa.